Exploring the ins and outs of securing a Shopify Capital Loan, this introduction sets the stage for a deep dive into the intricacies of the process. With a blend of informative content and engaging narrative, readers are bound to find valuable insights right from the start.

In the subsequent paragraph, we will delve into the specifics of what a Shopify Capital Loan entails, shedding light on its benefits and significance for small businesses.

Introduction

A Shopify Capital Loan is a financing option offered by Shopify to eligible merchants, providing them with access to capital to invest in their businesses. This loan is tailored specifically for Shopify users, making the application and repayment process seamless and convenient.

Having access to a Shopify Capital Loan can bring numerous benefits to small businesses, such as quick approval processes, competitive interest rates, and flexible repayment options. This financial support can help merchants expand their product lines, invest in marketing strategies, or manage cash flow effectively.

Importance of Access to Capital for Small Businesses

Access to capital is crucial for small businesses to thrive and grow. It enables entrepreneurs to seize opportunities for expansion, innovate their products or services, and navigate through unexpected challenges. Without adequate capital, businesses may struggle to invest in inventory, technology upgrades, or marketing efforts, limiting their ability to compete in the market effectively.

Eligibility Criteria

To be eligible for a Shopify Capital Loan, applicants must meet certain requirements set by Shopify. By understanding these criteria and working to fulfill them, applicants can increase their chances of being approved for a loan.

General Eligibility Requirements:

- Active Shopify account with at least 3 months of processing history

- Minimum monthly revenue threshold

- Compliance with Shopify's terms of service

Specific Qualifications Shopify Looks For:

- Consistent sales and revenue growth

- Low return and dispute rates

- Positive customer feedback and reviews

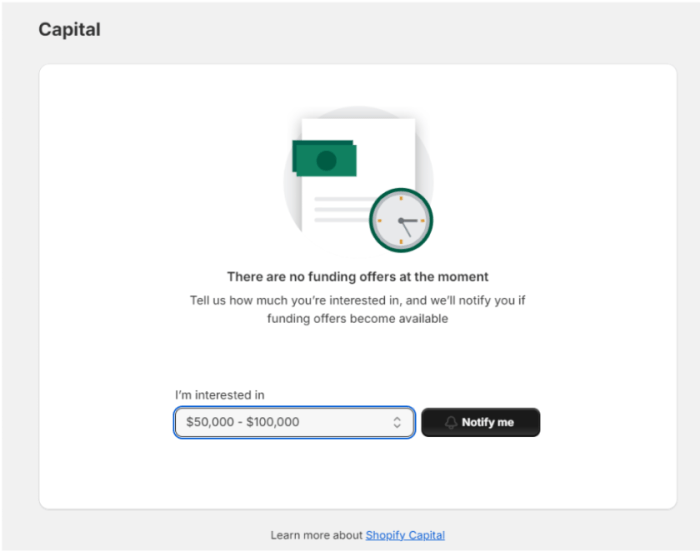

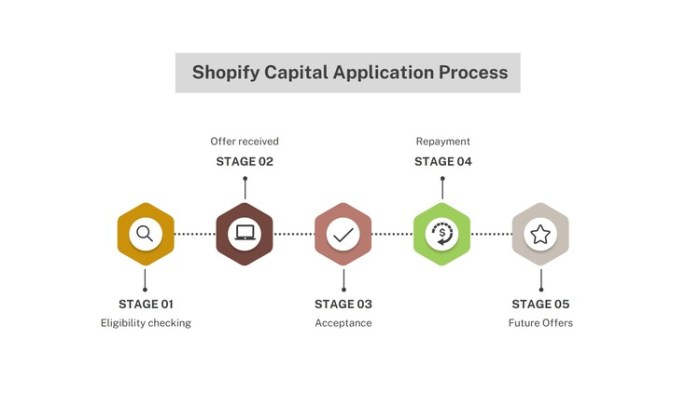

Application Process

When applying for a Shopify Capital Loan, there are specific steps you need to follow to ensure a smooth process and increase your chances of approval.

Step 1: Assess Your Eligibility

- Check if you meet the eligibility criteria Artikeld by Shopify Capital.

- Ensure your business has been operating for at least 6 months and generates a minimum revenue threshold.

Step 2: Log in to Your Shopify Account

- Access your Shopify dashboard and navigate to the Capital section.

- Click on the option to apply for a loan.

Step 3: Complete the Application Form

- Fill out the required fields with accurate information about your business, revenue, and loan amount.

- Double-check all details before submitting the application.

Step 4: Provide Necessary Documentation

- Prepare documents such as bank statements, sales reports, and business information to support your application.

- Ensure all documents are up-to-date and organized for easy submission.

Step 5: Wait for Approval

- After submitting your application, wait for Shopify Capital to review and approve your loan request.

- Once approved, the funds will be disbursed directly to your business account.

Financial Health Assessment

When applying for a Shopify Capital loan, your business's financial health plays a crucial role in the approval decision. Shopify evaluates various financial metrics to determine the risk associated with lending to your business.

Evaluation Factors

- Revenue Trends: Shopify assesses your business's revenue trends to gauge its growth and stability. Consistent revenue growth can indicate a healthy financial position.

- Profitability: The profitability of your business is crucial as it demonstrates your ability to generate profits and repay the loan. Shopify looks at your profit margins and overall profitability.

- Cash Flow: Cash flow is essential for meeting financial obligations, including loan repayments. Positive cash flow signifies your business's ability to manage its finances effectively.

- Debt-to-Equity Ratio: The debt-to-equity ratio reflects your business's leverage and financial risk. Lower ratios are generally more favorable as they indicate lower debt levels.

Improving Approval Chances

- Enhance Revenue Streams: You can improve your approval chances by diversifying your revenue streams and increasing sales through various channels.

- Optimize Profitability: Focus on improving your profit margins by reducing costs, increasing efficiencies, and pricing products/services competitively.

- Manage Cash Flow: Monitor your cash flow closely and implement strategies to ensure consistent cash inflows to cover expenses and repayments.

- Reduce Debt Levels: Paying off existing debts and managing your debt-to-equity ratio can enhance your financial health and increase your chances of loan approval.

Loan Amount and Terms

When it comes to Shopify Capital Loans, understanding the loan amount and repayment terms is crucial for effectively managing the loan. Let's dive into how Shopify determines the loan amount and the terms and conditions associated with these loans.

Loan Amount Determination

Shopify determines the loan amount for approved applicants based on their sales history and performance on the platform. The loan amount can range from a few thousand dollars to up to $1,000,000, depending on the merchant's sales volume and other factors.

Shopify considers various data points, such as the merchant's revenue, growth trends, and store history, to calculate an appropriate loan amount that aligns with the merchant's business needs.

Repayment Terms and Conditions

The repayment terms and conditions associated with a Shopify Capital Loan are designed to be flexible and manageable for merchants. Repayment is made through a fixed percentage of daily sales, which means that merchants repay the loan as they make sales on their Shopify store.

There are no fixed monthly payments or interest rates, making it easier for merchants to manage their cash flow.Understanding these terms can help merchants plan and budget effectively, ensuring that they can meet their repayment obligations without impacting their day-to-day operations.

By staying informed about the loan amount and repayment terms, merchants can make strategic decisions to maximize the benefits of a Shopify Capital Loan for their business.

Alternative Funding Options

When a business is not approved for a Shopify Capital Loan, there are several alternative funding options available to consider. It is important to explore these options carefully and choose the one that best suits the business's needs and financial situation.

Bank Loans

Bank loans are a common funding option for businesses. They typically offer lower interest rates compared to other sources of funding, making them an attractive option for businesses with a strong credit history. However, the application process for bank loans can be lengthy and require a lot of documentation.

Business Credit Cards

Business credit cards can provide a convenient way to access funds quickly. They are often easier to qualify for than traditional bank loans, but they come with higher interest rates. Business owners should be cautious when using credit cards for funding, as high balances can quickly accumulate and lead to financial strain.

Peer-to-Peer Lending

Peer-to-peer lending platforms connect borrowers with individual investors willing to lend money. This option can be more flexible than traditional bank loans and may offer competitive interest rates. However, borrowers should be aware of the risks involved, as peer-to-peer lending is not regulated in the same way as traditional banking institutions.

Venture Capital

Venture capital is a type of funding provided by investors in exchange for equity in the business. This option is more suitable for high-growth startups with the potential for significant returns. While venture capital can provide substantial funding, it also involves giving up a portion of ownership and decision-making control.

Crowdfunding

Crowdfunding platforms allow businesses to raise funds from a large number of individuals. This option can be a good way to generate capital quickly and engage with potential customers. However, successful crowdfunding campaigns require a well-thought-out strategy and compelling pitch to attract backers.

Conclusion

When considering alternative funding options, it is essential for businesses to evaluate their specific needs, financial situation, and long-term goals. Each funding source comes with its own set of pros and cons, so it is crucial to choose wisely based on what aligns best with the business's objectives.

End of Discussion

Concluding our discussion on obtaining a Shopify Capital Loan, this section encapsulates key takeaways and leaves readers with a lasting impression of the importance of capital accessibility for business growth.

Essential FAQs

What are the general eligibility requirements for a Shopify Capital Loan?

To be eligible for a Shopify Capital Loan, a business must meet certain criteria such as having a history of sales through Shopify and being located in a supported country.

How does Shopify evaluate the financial health of a business?

Shopify assesses the financial health of a business by looking at various factors including revenue trends, profit margins, and overall sales performance.

What happens if a business is not approved for a Shopify Capital Loan?

If a business is not approved for a Shopify Capital Loan, they can explore alternative funding options such as traditional bank loans, crowdfunding, or seeking investors.

![5 Best eCommerce Marketing Digital Agencies [2024 Edition]](https://share.radartasik.id/wp-content/uploads/2025/08/Best-E-Commerce-Marketing-Agencies-2048x1024-1-120x86.jpg)