Delving into The Role of ESG in Deepak Nitrite’s Market Value, this introduction beckons readers with a wealth of insights, promising a journey filled with knowledge and intrigue.

Exploring the significance of ESG criteria and its impact on Deepak Nitrite's market value is crucial in understanding the dynamics of sustainable business practices.

The Importance of ESG Criteria

Environmental, Social, and Governance (ESG) criteria are a set of standards that socially conscious investors use to evaluate companies' operations and impact. The ESG criteria encompass a wide range of factors, including how a company manages its carbon footprint, treats its employees, and upholds ethical business practices.

Influence on Market Value

- Companies that prioritize ESG factors tend to have higher market value and attract more investors. This is because investors are increasingly looking for sustainable and socially responsible investment opportunities.

- By focusing on ESG criteria, companies like Deepak Nitrite can mitigate risks, build long-term resilience, and create value for all stakeholders, not just shareholders.

- ESG performance can also serve as a key differentiator in a competitive market, helping companies stand out and attract a broader investor base.

Enhancing Reputation with Investors

- Deepak Nitrite's commitment to ESG practices not only enhances its reputation among investors but also builds trust and credibility in the market.

- Investors are more likely to support companies that demonstrate a strong commitment to sustainability, social responsibility, and good governance practices.

- By integrating ESG considerations into its business strategy, Deepak Nitrite can strengthen its relationships with investors, improve risk management, and drive long-term value creation.

Deepak Nitrite’s ESG Initiatives

Deepak Nitrite, a leading chemical manufacturing company, has implemented several ESG initiatives to enhance its sustainability practices and social responsibility.

Carbon Footprint Reduction

- Deepak Nitrite has set ambitious targets to reduce its carbon emissions and increase energy efficiency across its operations.

- The company invests in renewable energy sources and constantly monitors its carbon footprint to identify areas for improvement.

Water Conservation

- Deepak Nitrite focuses on reducing water consumption and implementing water recycling systems in its manufacturing processes.

- The company collaborates with local communities to promote water conservation and sustainable water management practices.

Employee Well-being

- Deepak Nitrite prioritizes the health and safety of its employees by providing training programs, health check-ups, and a safe working environment.

- The company also supports employee development and welfare initiatives to ensure a positive work culture.

Supplier Engagement

- Deepak Nitrite works closely with its suppliers to ensure they adhere to ethical and sustainable practices in their operations.

- The company conducts regular audits and evaluations to monitor supplier compliance with ESG criteria.

Industry Peers Comparison

Deepak Nitrite's ESG efforts set it apart from many industry peers who are yet to prioritize sustainability and social responsibility in their operations. By proactively addressing environmental and social issues, Deepak Nitrite not only enhances its reputation but also contributes to a more sustainable future.

Impact of ESG Performance on Financial Performance

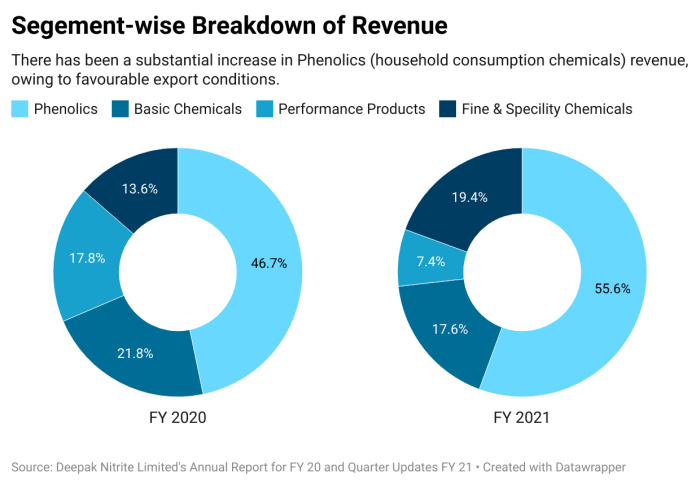

The ESG performance of a company like Deepak Nitrite can have a significant impact on its financial results

Correlation between ESG Performance and Financial Results

Deepak Nitrite's strong ESG performance can positively influence its financial performance in various ways. For example, by reducing environmental impact and improving energy efficiency, the company can lower operational costs and increase profitability. Additionally, a strong focus on social factors such as employee well-being and community engagement can enhance the company's reputation and attract investors who prioritize ESG criteria.

Examples of Improved Market Value through Strong ESG Performance

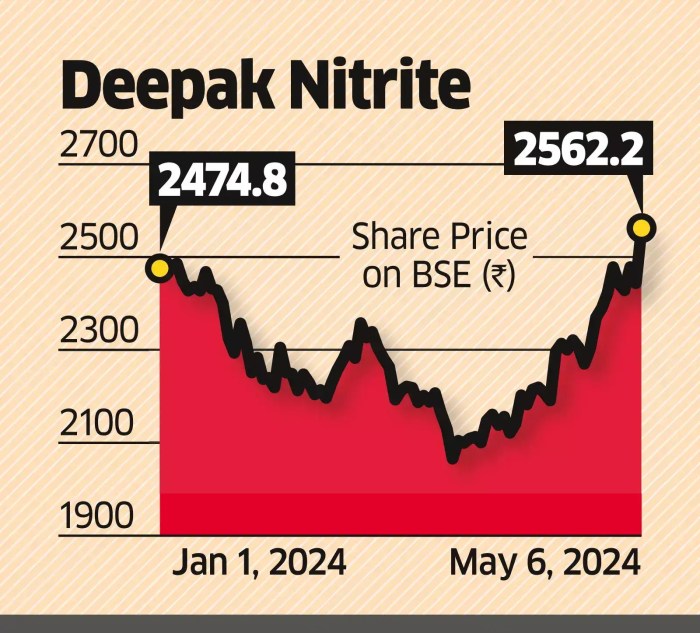

- Increased investor confidence: Companies with strong ESG performance are often perceived as more sustainable and responsible, leading to higher investor confidence and potentially driving up stock prices.

- Access to capital: Strong ESG performance can help companies access a wider pool of capital as ESG-focused investors are increasingly looking to invest in businesses that align with their values.

- Competitive advantage: By integrating ESG considerations into their business strategy, companies like Deepak Nitrite can gain a competitive edge in the market, attracting customers who prefer environmentally and socially responsible products/services.

Risks Associated with Poor ESG Performance

Poor ESG performance can pose several risks for Deepak Nitrite, including:

- Reputational damage: Negative environmental or social practices can lead to reputational damage, affecting customer trust and investor confidence.

- Regulatory fines and penalties: Non-compliance with ESG regulations can result in costly fines and penalties, impacting the company's bottom line.

- Lack of access to capital: Investors and lenders may be hesitant to support companies with poor ESG performance, limiting access to capital for growth and development.

Investor Perception and Market Value

Investors play a crucial role in determining the market value of companies, and their perception of Environmental, Social, and Governance (ESG) factors can significantly impact investment decisions.

Investor Evaluation of ESG Factors

- Investors consider ESG factors as indicators of a company's long-term sustainability and risk management practices.

- Deepak Nitrite's strong ESG performance can attract socially responsible investors who prioritize sustainability and ethical practices.

- ESG ratings and disclosures can influence investor perception of Deepak Nitrite's commitment to responsible business practices.

Influence of ESG Disclosures on Investor Decisions

- Transparent ESG disclosures can build trust with investors by providing insights into Deepak Nitrite's performance on key ESG metrics.

- Investors use ESG information to assess the potential financial risks and opportunities associated with investing in Deepak Nitrite.

- Positive ESG disclosures can enhance investor confidence in the company's management and governance practices.

Aligning ESG Strategy to Enhance Market Value

- Deepak Nitrite can align its ESG strategy with industry best practices and standards to improve its ESG performance and attract a wider investor base.

- Engaging with stakeholders and incorporating their feedback into ESG initiatives can demonstrate Deepak Nitrite's commitment to sustainability and responsible business practices.

- Continuous monitoring and reporting of ESG performance can help Deepak Nitrite track progress, identify areas for improvement, and communicate effectively with investors.

Epilogue

In conclusion, The Role of ESG in Deepak Nitrite’s Market Value sheds light on the pivotal relationship between ESG initiatives and market performance, underscoring the importance of aligning sustainable practices with financial success.

FAQ Insights

How do ESG criteria influence a company's market value?

ESG criteria impact market value by showcasing a company's commitment to environmental, social, and governance practices, which can attract socially responsible investors.

What are some potential risks of poor ESG performance for Deepak Nitrite?

Poor ESG performance can lead to reputational damage, decreased investor confidence, and regulatory issues for Deepak Nitrite, ultimately affecting its market value.

How can Deepak Nitrite enhance its market value through ESG strategies?

Deepak Nitrite can enhance market value by implementing robust ESG initiatives, transparently disclosing ESG performance, and aligning its strategy with investor expectations.

![5 Best eCommerce Marketing Digital Agencies [2024 Edition]](https://share.radartasik.id/wp-content/uploads/2025/08/Best-E-Commerce-Marketing-Agencies-2048x1024-1-120x86.jpg)